Risk Acceptance

Risk acceptance is a deliberate decision to acknowledge a certain level of risk without active efforts to mitigate or transfer it. It can be a valid strategy in situations where the cost or effort of risk reduction exceeds the potential loss.

Risk Tolerance

Visual powered by Canva

Visual powered by Canva

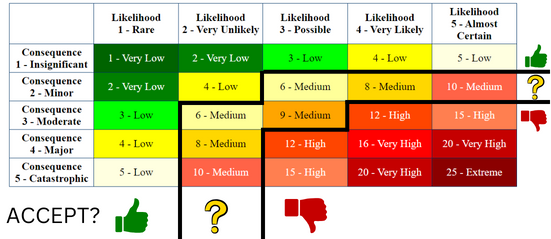

Define your organization's risk tolerance level, which is the threshold at which you are comfortable accepting risk. Similar to the example image provided, draw lines on the risk matrix to visualize threshold boundaries. The resulting risk appetite guides decision-making regarding which risks to accept.

Cost-Benefit Analysis

Determine whether the costs of risk reduction measures outweigh the potential losses. In some cases, it may be more financially prudent to accept certain risks. Thoroughly document the results of this analysis and your decision rationale to ensure that all stakeholders are aware of accepted risks and their potential impact.

Risk Termination

Risk termination involves taking proactive measures to eliminate specific risks altogether. While not always feasible, it can be a highly effective strategy in certain situations.

Asset Disposal

If an asset poses a significant risk that cannot be effectively mitigated, consider disposing of it. This eliminates the associated risk but requires careful planning.

Regulatory Non-Compliance

Regulatory compliance refers to adhering to laws and regulations applicable to a particular industry. Legal breaches and violations of safety standards are examples of failing to meet regulatory compliance. Asset disposal is a viable option to eliminate the associated risk of non-compliance.